Your Sports Facility’s Business Plan: The Finances

This is the fourth in a series of posts on creating a business plan for a sports facility. In the past weeks, we discussed creating a sports facility business objective, creating a marketing plan, and creating an operations plan. Next week, we’ll discuss how to add an exit strategy to your sports facility’s business plan.

Now that you’ve thought out the details of your products, staff, and operations, you can use that info to make educated guesses about how your business will do financially.

We’ll do that by estimating your revenue, comparing it to your expenses, and finally figuring out if you’ll make enough of a profit based on those numbers.

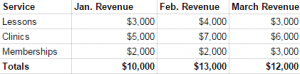

Step 1: Monthly Revenue Guesses

First, review the marketing plan you created, including your busy seasons and your major events and promotions. Then, estimate how much revenue they’re likely to bring in based on your pricing.

Don’t be optimistic. This is the time to be conservative. It’s always better to over-deliver than to come up short of your estimates. (Plus, a conservative plan is always more attractive to potential investors, if you’re looking for them.)

You should make a simple chart that looks something like this:

Step 2: Monthly Expense Projections

Now it’s time to get totals for all your business expenses.

- Check the marketing section of your business plan. Add up the monthly costs of all your marketing tools.

- Check the operations section of your business plan. Add up all monthly staff costs, such as the salary, apparel, unemployment and bonuses.

- Check the operations section of your business plan again and add up all the monthly costs for your building and equipment. This includes utilities, monthly payments plus interest on any equipment that you’ve financed, rent costs, and any other regular building costs.

- Add up the monthly cost of any other other ongoing expenses, such as taxes, accountant fees, insurance, internet and phone, scheduling software like eSoft Planner, cleaning and maintenance, and security. Larger, one-time or semi-regular annual expenses, such as legal fees, should also also be split up into monthly amounts and added here. Even if you will have paid certain expenses upfront, you should still typically account for them monthly so you’ll have the money ready when the expenses come up again next year.

- Total all those expenses together to get a final monthly number. If your costs and revenues will vary a lot by month, it’s OK to list each month’s expenses separately.

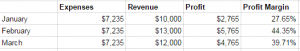

Step 3: Check Your Profit Margin

The profit margin is a handy figure that lets you know what percentage of your revenue is going to profit. Best practices for target profit margin depend on what kind of business you have, but I always shoot for around 30% minimum for my sports facility.

You can find the profit margin by dividing the expected profit by the total expected revenue. (This is where my bachelor’s degree in accounting comes in handy!)

For example:

Step 4: Troubleshoot and Adjust

If your profit margin drops below 30% consistently, it’s time to make some adjustments.

Here’s what to do: Take the same cost-vs-benefit business logic you’re using to plan your finances and apply it to each expense on your list. What’s the least profitable piece of equipment? Get rid of it. Is there a least profitable area of your building that you can eliminate? What about your staff — is each staff member’s pay bringing in his fair share of revenue? Maybe you should switch to a commission-based pay structure.

This step — the finances — is the meatiest part of your business plan and incorporates all the previous steps. If these numbers don’t look right, you NEED to fix them before you move forward.

Next, for a complete business plan, you’ll consider and plan for your exit strategy — which is particularly important if you have investors or partners.

More questions? Contact me directly.